Majlis Issue 11 Seite 10

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.Klicken Sie hier um zur Online-Version zu gelangen.

Inhalt

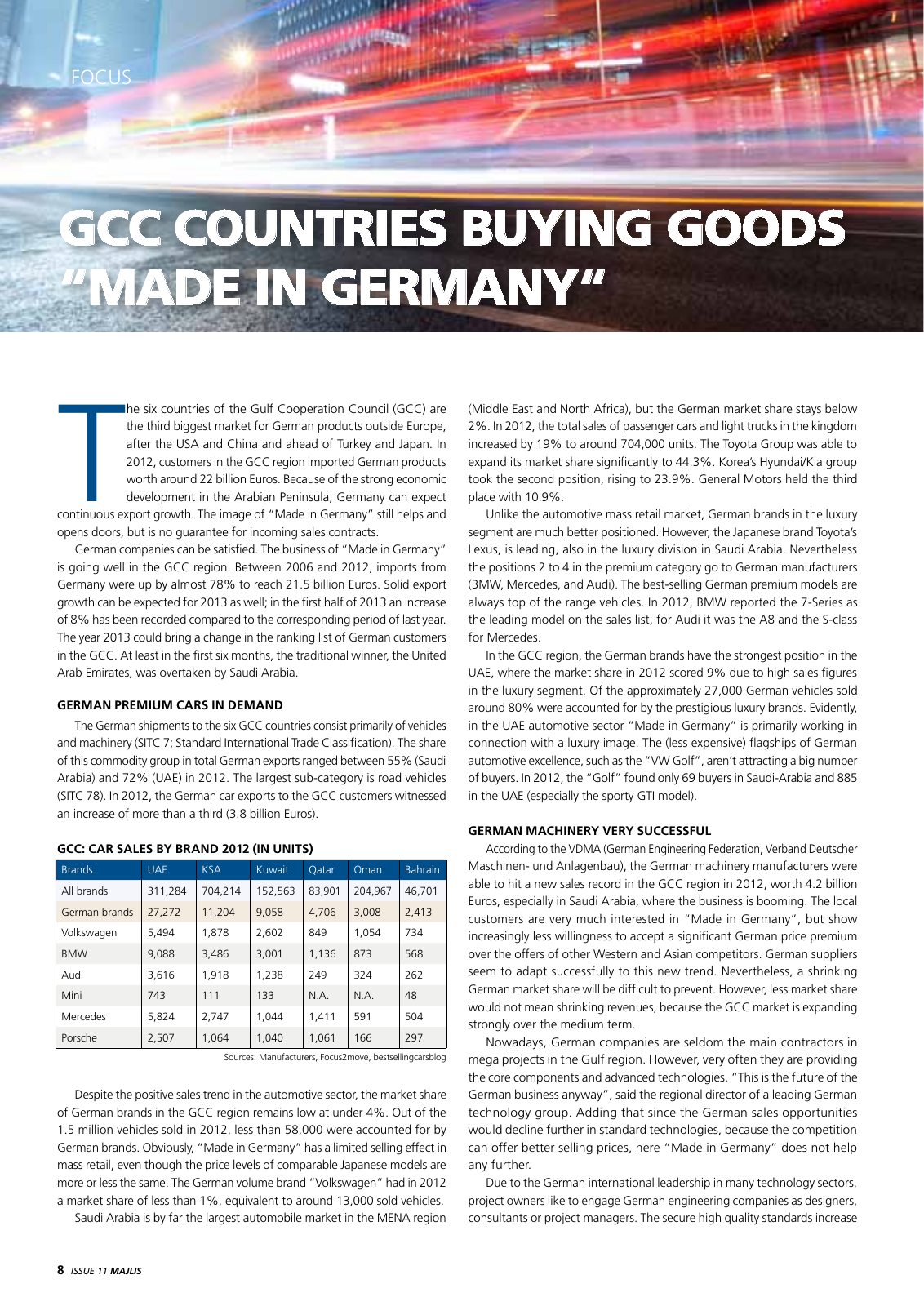

FOCUS T he six countries of the Gulf Cooperation Council GCC are the third biggest market for German products outside Europe after the USA and China and ahead of Turkey and Japan In 2012 customers in the GCC region imported German products worth around 22 billion Euros Because of the strong economic development in the Arabian Peninsula Germany can expect continuous export growth The image of Made in Germany still helps and opens doors but is no guarantee for incoming sales contracts German companies can be satisfied The business of Made in Germany is going well in the GCC region Between 2006 and 2012 imports from Germany were up by almost 78 to reach 21 5 billion Euros Solid export growth can be expected for 2013 as well in the first half of 2013 an increase of 8 has been recorded compared to the corresponding period of last year The year 2013 could bring a change in the ranking list of German customers in the GCC At least in the first six months the traditional winner the United Arab Emirates was overtaken by Saudi Arabia GERmaN PREmIUm caRS IN dEmaNd The German shipments to the six GCC countries consist primarily of vehicles and machinery SITC 7 Standard International Trade Classification The share of this commodity group in total German exports ranged between 55 Saudi Arabia and 72 UAE in 2012 The largest sub category is road vehicles SITC 78 In 2012 the German car exports to the GCC customers witnessed an increase of more than a third 3 8 billion Euros Gcc caR SaLES By BRaNd 2012 IN UNITS Brands UAE KSA Kuwait Qatar Oman Bahrain All brands 311 284 704 214 152 563 83 901 204 967 46 701 German brands 27 272 11 204 9 058 4 706 3 008 2 413 Volkswagen 5 494 1 878 2 602 849 1 054 734 BMW 9 088 3 486 3 001 1 136 873 568 Audi 3 616 1 918 1 238 249 324 262 Mini 743 111 133 N A N A 48 Mercedes 5 824 2 747 1 044 1 411 591 504 Porsche 2 507 1 064 1 040 1 061 166 297 Sources Manufacturers Focus2move bestsellingcarsblog Despite the positive sales trend in the automotive sector the market share of German brands in the GCC region remains low at under 4 Out of the 1 5 million vehicles sold in 2012 less than 58 000 were accounted for by German brands Obviously Made in Germany has a limited selling effect in mass retail even though the price levels of comparable Japanese models are more or less the same The German volume brand Volkswagen had in 2012 a market share of less than 1 equivalent to around 13 000 sold vehicles Saudi Arabia is by far the largest automobile market in the MENA region Middle East and North Africa but the German market share stays below 2 In 2012 the total sales of passenger cars and light trucks in the kingdom increased by 19 to around 704 000 units The Toyota Group was able to expand its market share significantly to 44 3 Korea s Hyundai Kia group took the second position rising to 23 9 General Motors held the third place with 10 9 Unlike the automotive mass retail market German brands in the luxury segment are much better positioned However the Japanese brand Toyota s Lexus is leading also in the luxury division in Saudi Arabia Nevertheless the positions 2 to 4 in the premium category go to German manufacturers BMW Mercedes and Audi The best selling German premium models are always top of the range vehicles In 2012 BMW reported the 7 Series as the leading model on the sales list for Audi it was the A8 and the S class for Mercedes In the GCC region the German brands have the strongest position in the UAE where the market share in 2012 scored 9 due to high sales figures in the luxury segment Of the approximately 27 000 German vehicles sold around 80 were accounted for by the prestigious luxury brands Evidently in the UAE automotive sector Made in Germany is primarily working in connection with a luxury image The less expensive flagships of German automotive excellence such as the VW Golf aren t attracting a big number of buyers In 2012 the Golf found only 69 buyers in Saudi Arabia and 885 in the UAE especially the sporty GTI model GERmaN machINERy VERy SUccESSFUL According to the VDMA German Engineering Federation Verband Deutscher Maschinen und Anlagenbau the German machinery manufacturers were able to hit a new sales record in the GCC region in 2012 worth 4 2 billion Euros especially in Saudi Arabia where the business is booming The local customers are very much interested in Made in Germany but show increasingly less willingness to accept a significant German price premium over the offers of other Western and Asian competitors German suppliers seem to adapt successfully to this new trend Nevertheless a shrinking German market share will be difficult to prevent However less market share would not mean shrinking revenues because the GCC market is expanding strongly over the medium term Nowadays German companies are seldom the main contractors in mega projects in the Gulf region However very often they are providing the core components and advanced technologies This is the future of the German business anyway said the regional director of a leading German technology group Adding that since the German sales opportunities would decline further in standard technologies because the competition can offer better selling prices here Made in Germany does not help any further Due to the German international leadership in many technology sectors project owners like to engage German engineering companies as designers consultants or project managers The secure high quality standards increase GCC CouNtRIEs buYING GooDs MADE IN GERMANY 8 ISSUE 11 MAJLIs