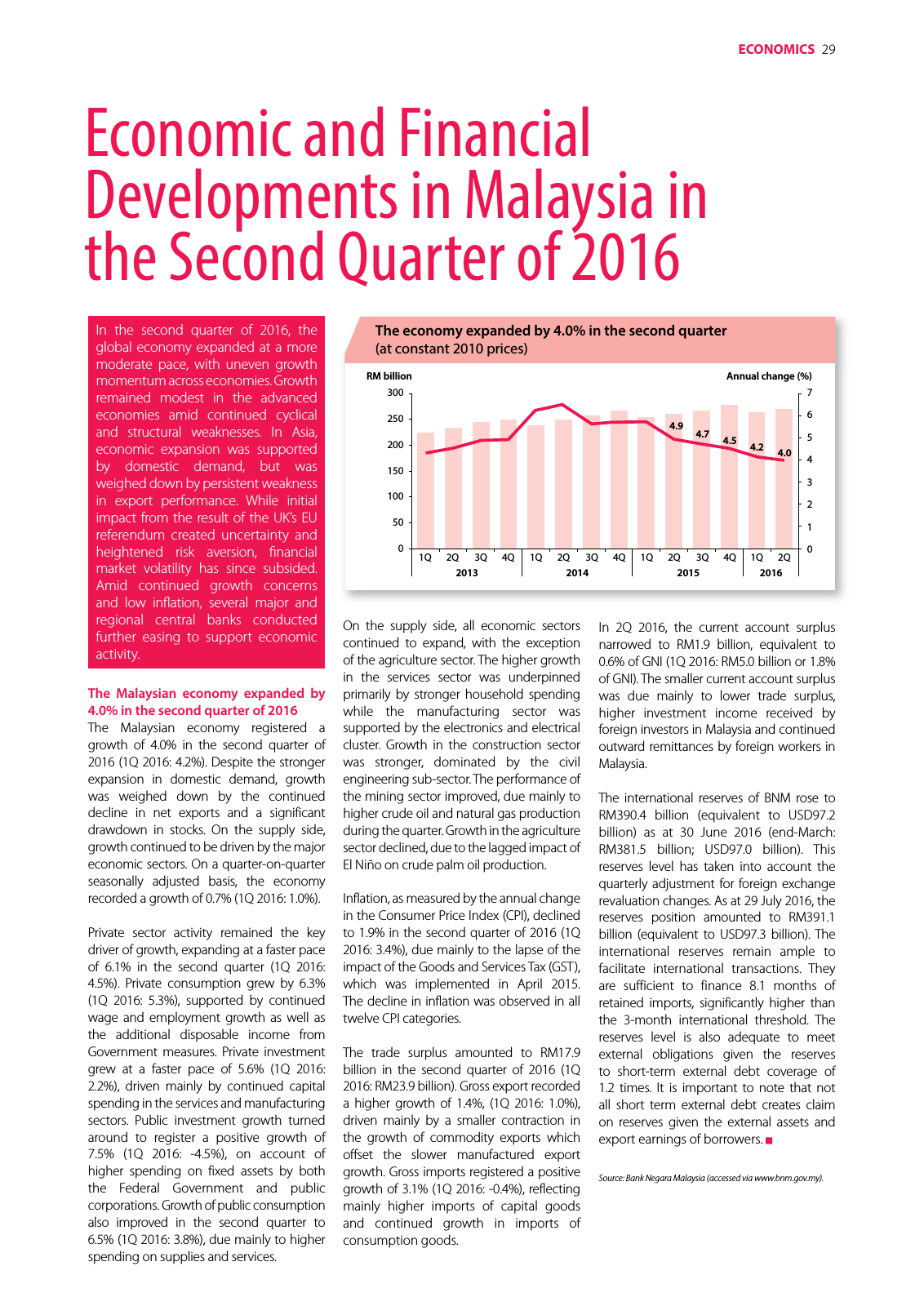

The economy expanded by 4 0 in the second quarter at constant 2010 prices 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 1Q 2Q3Q 4Q 2013 2014 2015 2016 300 250 200 150 100 50 0 7 6 5 4 3 2 1 0 4 9 4 7 4 5 4 2 4 0 RM billion Annual change 29eCOnOmiCS In the second quarter of 2016 the global economy expanded at a more moderate pace with uneven growth momentum across economies Growth remained modest in the advanced economies amid continued cyclical and structural weaknesses In Asia economic expansion was supported by domestic demand but was weighed down by persistent weakness in export performance While initial impact from the result of the UK s EU referendum created uncertainty and heightened risk aversion financial market volatility has since subsided Amid continued growth concerns and low inflation several major and regional central banks conducted further easing to support economic activity Economic and Financial Developments in Malaysia in the Second Quarter of 2016 The Malaysian economy expanded by 4 0 in the second quarter of 2016 The Malaysian economy registered a growth of 4 0 in the second quarter of 2016 1Q 2016 4 2 Despite the stronger expansion in domestic demand growth was weighed down by the continued decline in net exports and a significant drawdown in stocks On the supply side growth continued to be driven by the major economic sectors On a quarter on quarter seasonally adjusted basis the economy recorded a growth of 0 7 1Q 2016 1 0 Private sector activity remained the key driver of growth expanding at a faster pace of 6 1 in the second quarter 1Q 2016 4 5 Private consumption grew by 6 3 1Q 2016 5 3 supported by continued wage and employment growth as well as the additional disposable income from Government measures Private investment grew at a faster pace of 5 6 1Q 2016 2 2 driven mainly by continued capital spending in the services and manufacturing sectors Public investment growth turned around to register a positive growth of 7 5 1Q 2016 4 5 on account of higher spending on fixed assets by both the Federal Government and public corporations Growth of public consumption also improved in the second quarter to 6 5 1Q 2016 3 8 due mainly to higher spending on supplies and services On the supply side all economic sectors continued to expand with the exception of the agriculture sector The higher growth in the services sector was underpinned primarily by stronger household spending while the manufacturing sector was supported by the electronics and electrical cluster Growth in the construction sector was stronger dominated by the civil engineering sub sector The performance of the mining sector improved due mainly to higher crude oil and natural gas production during the quarter Growth in the agriculture sector declined due to the lagged impact of El Niño on crude palm oil production Inflation as measured by the annual change in the Consumer Price Index CPI declined to 1 9 in the second quarter of 2016 1Q 2016 3 4 due mainly to the lapse of the impact of the Goods and Services Tax GST which was implemented in April 2015 The decline in inflation was observed in all twelve CPI categories The trade surplus amounted to RM17 9 billion in the second quarter of 2016 1Q 2016 RM23 9 billion Gross export recorded a higher growth of 1 4 1Q 2016 1 0 driven mainly by a smaller contraction in the growth of commodity exports which offset the slower manufactured export growth Gross imports registered a positive growth of 3 1 1Q 2016 0 4 reflecting mainly higher imports of capital goods and continued growth in imports of consumption goods In 2Q 2016 the current account surplus narrowed to RM1 9 billion equivalent to 0 6 of GNI 1Q 2016 RM5 0 billion or 1 8 of GNI The smaller current account surplus was due mainly to lower trade surplus higher investment income received by foreign investors in Malaysia and continued outward remittances by foreign workers in Malaysia The international reserves of BNM rose to RM390 4 billion equivalent to USD97 2 billion as at 30 June 2016 end March RM381 5 billion USD97 0 billion This reserves level has taken into account the quarterly adjustment for foreign exchange revaluation changes As at 29 July 2016 the reserves position amounted to RM391 1 billion equivalent to USD97 3 billion The international reserves remain ample to facilitate international transactions They are sufficient to finance 8 1 months of retained imports significantly higher than the 3 month international threshold The reserves level is also adequate to meet external obligations given the reserves to short term external debt coverage of 1 2 times It is important to note that not all short term external debt creates claim on reserves given the external assets and export earnings of borrowers Source Bank Negara Malaysia accessed via www bnm gov my

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.