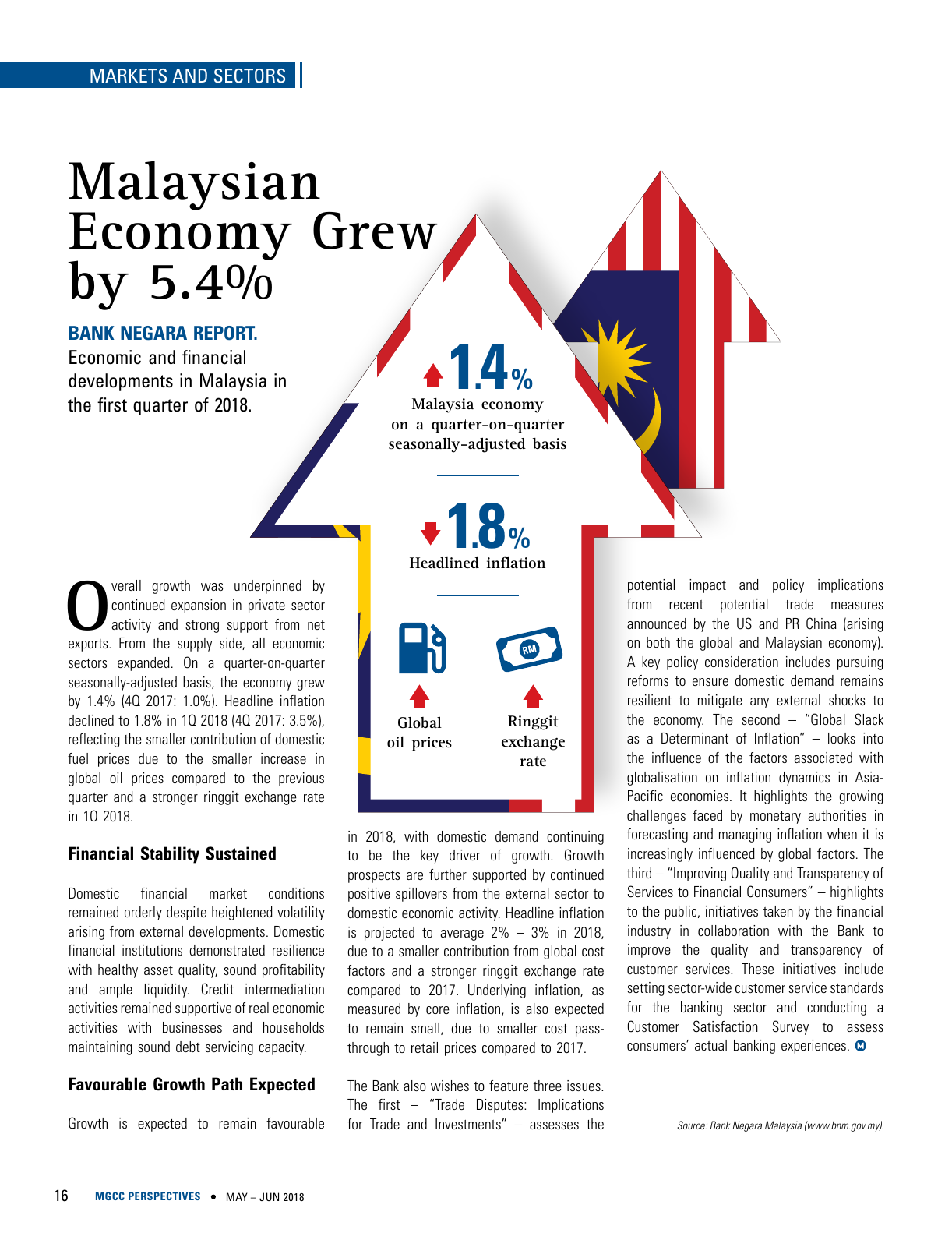

16 MGCC PERSPECTIVES MAY JUN 2018 MARKETS AND SECTORS BANK NEGARA REPORT Economic and financial developments in Malaysia in the first quarter of 2018 Malaysian Economy Grew by 5 4 Overall growth was underpinned by continued expansion in private sector activity and strong support from net exports From the supply side all economic sectors expanded On a quarter on quarter seasonally adjusted basis the economy grew by 1 4 4Q 2017 1 0 Headline inflation declined to 1 8 in 1Q 2018 4Q 2017 3 5 reflecting the smaller contribution of domestic fuel prices due to the smaller increase in global oil prices compared to the previous quarter and a stronger ringgit exchange rate in 1Q 2018 Financial Stability Sustained Domestic financial market conditions remained orderly despite heightened volatility arising from external developments Domestic financial institutions demonstrated resilience with healthy asset quality sound profitability and ample liquidity Credit intermediation activities remained supportive of real economic activities with businesses and households maintaining sound debt servicing capacity Favourable Growth Path Expected Growth is expected to remain favourable in 2018 with domestic demand continuing to be the key driver of growth Growth prospects are further supported by continued positive spillovers from the external sector to domestic economic activity Headline inflation is projected to average 2 3 in 2018 due to a smaller contribution from global cost factors and a stronger ringgit exchange rate compared to 2017 Underlying inflation as measured by core inflation is also expected to remain small due to smaller cost pass through to retail prices compared to 2017 The Bank also wishes to feature three issues The first Trade Disputes Implications for Trade and Investments assesses the Source Bank Negara Malaysia www bnm gov my potential impact and policy implications from recent potential trade measures announced by the US and PR China arising on both the global and Malaysian economy A key policy consideration includes pursuing reforms to ensure domestic demand remains resilient to mitigate any external shocks to the economy The second Global Slack as a Determinant of Inflation looks into the influence of the factors associated with globalisation on inflation dynamics in Asia Pacific economies It highlights the growing challenges faced by monetary authorities in forecasting and managing inflation when it is increasingly influenced by global factors The third Improving Quality and Transparency of Services to Financial Consumers highlights to the public initiatives taken by the financial industry in collaboration with the Bank to improve the quality and transparency of customer services These initiatives include setting sector wide customer service standards for the banking sector and conducting a Customer Satisfaction Survey to assess consumers actual banking experiences Malaysia economy on a quarter on quarter seasonally adjusted basis Headlined inflation 1 4 1 8 Global oil prices Ringgit exchange rate

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.