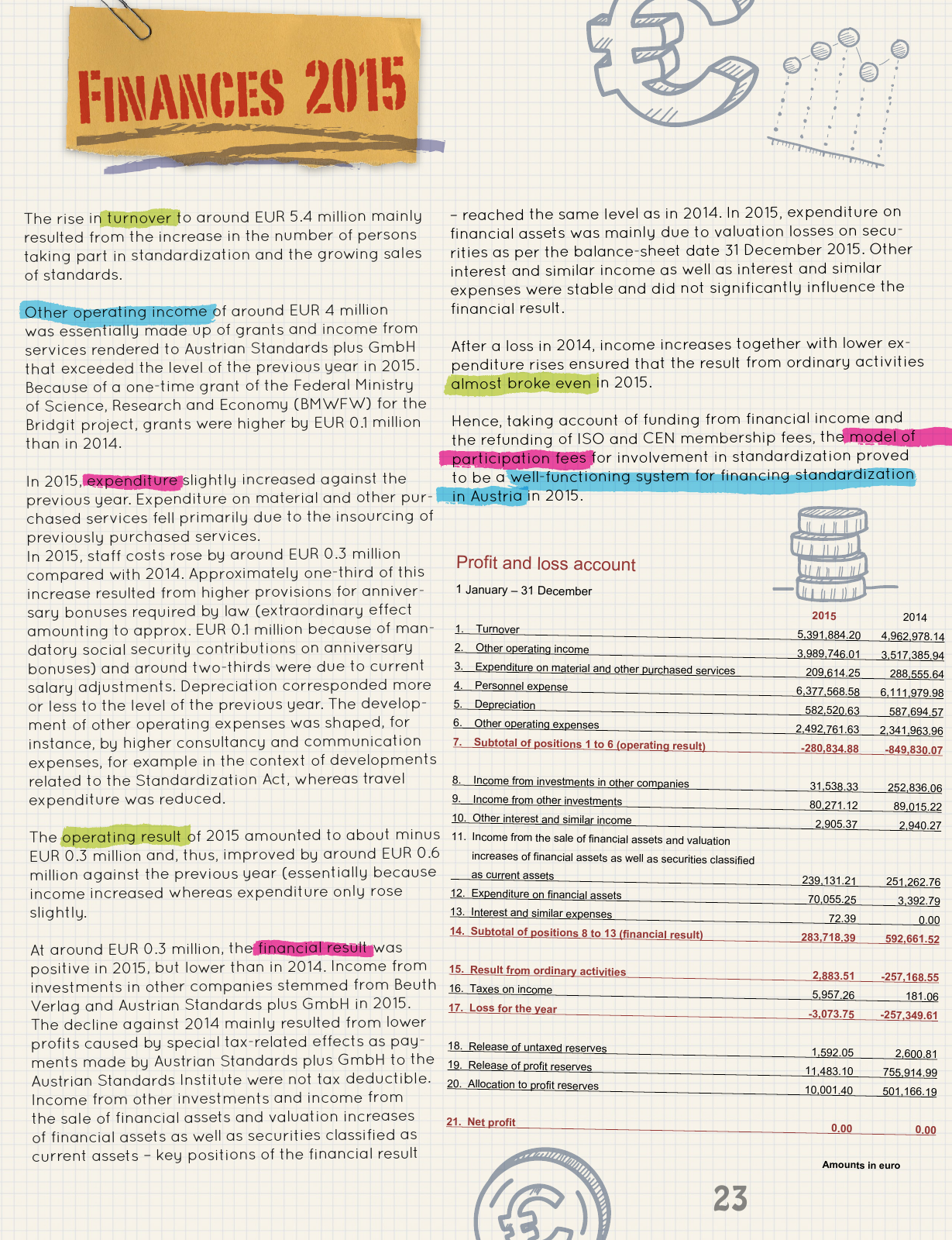

The rise in turnover to around EUR 5 4 million mainly resulted from the increase in the number of persons taking part in standardization and the growing sales of standards Other operating income of around EUR 4 million was essentially made up of grants and income from services rendered to Austrian Standards plus GmbH that exceeded the level of the previous year in 2015 Because of a one time grant of the Federal Ministry of Science Research and Economy BMWFW for the Bridgit project grants were higher by EUR 0 1 million than in 2014 In 2015 expenditure slightly increased against the previous year Expenditure on material and other pur chased services fell primarily due to the insourcing of previously purchased services In 2015 staff costs rose by around EUR 0 3 million compared with 2014 Approximately one third of this increase resulted from higher provisions for anniver sary bonuses required by law extraordinary effect amounting to approx EUR 0 1 million because of man datory social security contributions on anniversary bonuses and around two thirds were due to current salary adjustments Depreciation corresponded more or less to the level of the previous year The develop ment of other operating expenses was shaped for instance by higher consultancy and communication expenses for example in the context of developments related to the Standardization Act whereas travel expenditure was reduced The operating result of 2015 amounted to about minus EUR 0 3 million and thus improved by around EUR 0 6 million against the previous year essentially because income increased whereas expenditure only rose slightly At around EUR 0 3 million the financial result was positive in 2015 but lower than in 2014 Income from investments in other companies stemmed from Beuth Verlag and Austrian Standards plus GmbH in 2015 The decline against 2014 mainly resulted from lower profits caused by special tax related effects as pay ments made by Austrian Standards plus GmbH to the Austrian Standards Institute were not tax deductible Income from other investments and income from the sale of financial assets and valuation increases of financial assets as well as securities classified as current assets key positions of the financial result Finances 2015 Profit and loss account 1 January 31 December 2015 2014 1 Turnover 5 391 884 20 4 962 978 14 2 Other operating income 3 989 746 01 3 517 385 94 3 Expenditure on material and other purchased services 209 614 25 288 555 64 4 Personnel expense 6 377 568 58 6 111 979 98 5 Depreciation 582 520 63 587 694 57 6 Other operating expenses 2 492 761 63 2 341 963 96 7 Subtotal of positions 1 to 6 operating result 280 834 88 849 830 07 8 Income from investments in other companies 31 538 33 252 836 06 9 Income from other investments 80 271 12 89 015 22 10 Other interest and similar income 2 905 37 2 940 27 11 Income from the sale of financial assets and valuation increases of financial assets as well as securities classified as current assets 239 131 21 251 262 76 12 Expenditure on financial assets 70 055 25 3 392 79 13 Interest and similar expenses 72 39 0 00 14 Subtotal of positions 8 to 13 financial result 283 718 39 592 661 52 15 Result from ordinary activities 2 883 51 257 168 55 16 Taxes on income 5 957 26 181 06 17 Loss for the year 3 073 75 257 349 61 18 Release of untaxed reserves 1 592 05 2 600 81 19 Release of profit reserves 11 483 10 755 914 99 20 Allocation to profit reserves 10 001 40 501 166 19 21 Net profit 0 00 0 00 Amounts in euro reached the same level as in 2014 In 2015 expenditure on financial assets was mainly due to valuation losses on secu rities as per the balance sheet date 31 December 2015 Other interest and similar income as well as interest and similar expenses were stable and did not significantly influence the financial result After a loss in 2014 income increases together with lower ex penditure rises ensured that the result from ordinary activities almost broke even in 2015 Hence taking account of funding from financial income and the refunding of ISO and CEN membership fees the model of participation fees for involvement in standardization proved to be a well functioning system for financing standardization in Austria in 2015 23

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.